Next Gen Profit Ai:

Next Gen Profit Ai Signals That Spot Winning Trades Faster

Sign up now

Sign up now

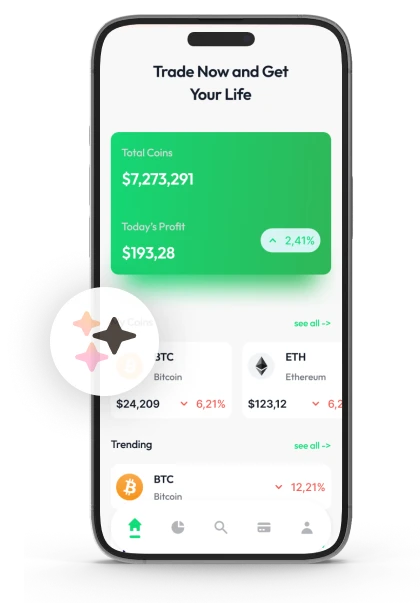

Next Gen Profit Ai supports traders at all experience levels by combining AI with a clean, easy to use interface. It delivers structured insights while continuously evaluating market conditions, helping users stay disciplined without feeling overwhelmed. This keeps traders organized and able to respond quickly to shifting trends in real time.

With high speed AI processing, the platform analyzes massive datasets and detects emerging patterns instantly. Users receive real time signals that highlight market shifts and potential opportunities. These fast insights improve decision making confidence and reduce the chance of missing key movements or early trend changes.

The copy trading feature lets users review strategies from experienced traders while keeping full control over execution. AI analytics add context by tracking current market behavior and supporting data driven decisions. By combining expert methods with advanced insights, Next Gen Profit Ai strengthens long term planning and investing outcomes.

Next Gen Profit Ai uses AI to monitor global markets continuously, detecting emerging patterns and structural shifts in real time. It processes live data and updates its machine learning models dynamically, staying flexible as conditions change across asset classes. Strong security safeguards protect user data and insights, making the platform reliable for daily analysis.

Next Gen Profit Ai turns complex market data into clear guidance, helping users trade with greater certainty. Its AI evaluates market behavior and delivers actionable signals for entry and exit decisions in real time. This approach improves accuracy and reduces emotional bias, allowing traders to act quickly and confidently when volatility rises.

The AI in Next Gen Profit Ai learns from both historical and live data to adapt to changing market behavior. It identifies early signs of shifts and presents them in an easy to read format. This ongoing learning improves awareness, supports fast responses, and helps traders maintain a disciplined routine even during unpredictable market moves.

Copy trading in Next Gen Profit Ai offers access to strategies from proven coaches, while keeping control in the user’s hands. Traders review each method and decide what to execute manually, instead of relying on automatic orders. AI trend analysis tracks long term movement, helping users blend expert approaches with data backed decisions for steady portfolio growth.

Privacy and transparency are core to Next Gen Profit Ai, which protects user data through responsible handling and clear policies. With no trading executed on the platform, the focus remains on information security and trust. This privacy first setup lets users explore AI market intelligence without worrying about data misuse or exposure.

Next Gen Profit Ai functions as an analytics hub where AI supports traders rather than replacing them. Users access tools that interpret trends, test strategies, and monitor asset behavior in a structured format. By translating complex market data into clear insights, the platform encourages more deliberate and informed trading decisions.

Real time AI monitoring keeps users aligned with market movement as it happens. Next Gen Profit Ai scans crypto markets continuously, spotting key price actions and trend shifts instantly. These fast, clear updates help traders react quickly, refine strategies confidently, and stay aligned with evolving conditions for better performance.

Next Gen Profit Ai delivers market analysis that reduces emotional trading by simplifying complex data into clear insights. AI systems process large datasets at high speed, detecting trends and potential setups. The platform acts as a data driven tool for interpreting signals in the fast paced crypto market, helping traders stay disciplined and confident.

The AI engine in Next Gen Profit Ai adapts quickly to changing conditions, updating analysis in real time. Price moves are assessed with precision and timing to deliver relevant insights. This structure improves analytical flow, lowers uncertainty, and ensures users receive organized market views when they need them most.

Machine learning within Next Gen Profit Ai continuously learns from both historical and current market behavior. This adaptive approach boosts responsiveness and keeps analysis aligned with ongoing price changes. As the market evolves, the platform stays in sync with the crypto ecosystem, helping users keep strategy consistent while adapting quickly.

Next Gen Profit Ai provides constant market access with 24/7 real time monitoring. Its AI framework processes data instantly, reacting to asset value changes as they occur. This continuous awareness helps traders monitor shifts without delay and respond more accurately, improving timing and execution in fast moving markets.

To ensure a smooth experience, Next Gen Profit Ai offers dedicated support for technical issues and platform use. Users receive prompt guidance to resolve problems and maximize functionality. From tutorials to live help, the support team keeps the system running efficiently so traders can focus on research and trading without disruption.

Next Gen Profit Ai empowers digital asset research with a powerful AI system that continuously scans market activity using fast data processing. It identifies emerging patterns and price shifts in real time, helping users improve timing, positioning, and strategy alignment. The adaptive framework keeps insights reliable and data driven, supporting traders at any level.

Rather than requiring constant market monitoring, Next Gen Profit Ai highlights the most important signals and potential opportunities. It also lets users view expert coach strategies without executing trades automatically, keeping full control in the trader’s hands. This setup supports quick responses to market changes while maintaining intentional decision making.

Security is a core focus for Next Gen Profit Ai, which protects user data through multi layer encryption and strict authentication. The platform also provides strong support for traders of all experience levels. With structured tools, clear guidance, and dependable safeguards, Next Gen Profit Ai helps users trade with greater confidence and consistency.

Consistency is built through a structured approach, and Next Gen Profit Ai helps traders achieve it across different timeframes. Whether users focus on fast entries or long term trend following, they can refine their strategy by reviewing price action, past performance, and risk tolerance. This creates a plan that stays aligned with broader market movement.

The AI analytics in Next Gen Profit Ai continuously refresh with live data, detecting significant patterns early. Traders gain an edge by responding faster and testing different styles using real time insights. The platform supports comparing approaches, adjusting tactics as trends shift, and making decisions that strengthen long term consistency and growth.

Market strategies can be fast and reactive or slow and trend based. Short term trading focuses on immediate price changes, while long term approaches track broader direction. Next Gen Profit Ai evaluates both styles and provides comparative insights, helping users choose the strategy that matches their risk tolerance, time horizon, and trading preferences.

Liquidity impacts how smoothly trades execute and how prices behave. High liquidity usually stabilizes markets, while low liquidity can create sudden swings and gaps. Next Gen Profit Ai monitors liquidity patterns continuously, helping users recognize stable conditions and adjust their timing and strategy based on market depth and flow.

Planning risk and reward is key to consistent trading. Next Gen Profit Ai uses AI to identify important support and resistance levels, guiding users to spot risk zones and ideal points to reassess trades. This structured process supports disciplined decisions and helps users manage exposure without relying on automated execution.

AI driven market intelligence improves execution by converting complex data into clear insights. Next Gen Profit Ai processes large datasets in real time, detecting shifts and reducing emotional bias. These insights encourage disciplined trading and help users adapt strategies to evolving conditions, leading to more consistent performance.

Next Gen Profit Ai includes a full technical toolkit featuring MACD, Fibonacci Retracement, and the Stochastic Oscillator to help traders interpret market movement. Each tool offers a unique perspective, momentum, trend confirmation, or reversal probability, allowing users to analyze price action more deeply and improve decision making with clearer insight.

Fibonacci Retracement identifies possible reversal zones based on past price swings, helping users anticipate correction points. The Stochastic Oscillator signals when assets are overbought or oversold, while MACD tracks momentum and trend direction. Together, they create a balanced framework for more reliable planning and strategy building.

AI enhances this system by reducing noise and highlighting meaningful patterns. Next Gen Profit Ai combines indicator analysis with intelligent insights, helping users assess market conditions more accurately and adjust strategies as trends evolve. This integrated approach supports disciplined, confident trading and stronger risk management.

Market direction is shaped by trader sentiment as much as price movement. Sentiment analysis evaluates news, social media, and market activity to judge whether investors feel optimistic or cautious. Next Gen Profit Ai helps users decode these signals and build a structured view of sentiment, estimating how mood may influence future price action.

AI driven sentiment tools scan vast datasets to detect shifts in investor outlook. Identifying bullish or bearish sentiment helps traders anticipate volatility and shape better strategies. Bullish sentiment may suggest rising momentum, while bearish sentiment can indicate potential drops or increased uncertainty.

When combined with technical indicators, sentiment analysis offers a fuller market picture. Next Gen Profit Ai’s AI monitoring detects changes in dominant sentiment, helping users stay aligned with broader trends and make more informed decisions. This context aware insight supports disciplined trading and better timing in volatile markets.

Macroeconomic trends like inflation, employment data, and central bank policy influence crypto markets by shaping investor confidence and volatility. Next Gen Profit Ai applies AI powered macro analysis to show how these shifts impact digital asset valuations. For instance, rising inflation can increase demand for decentralized assets such as Bitcoin.

Regulatory announcements can also trigger market swings. Next Gen Profit Ai reviews historical reactions to policy changes, using AI to identify repeatable patterns and behavioral responses. This gives users clearer insight into how global economic developments may affect future price movement and risk.

Timing is critical in every market cycle, and Next Gen Profit Ai uses AI to study historical patterns alongside live data to highlight potential shifts in momentum or volatility. By monitoring price changes and key indicators, the platform helps users identify when major moves might be forming, supporting more accurate timing for planning and execution.

For deeper context, Next Gen Profit Ai tracks cyclical trends, volatility transitions, and breakout potential. These signals help users read the market’s rhythm and anticipate when conditions may shift into a new phase. The platform’s framework supports timely awareness and clearer interpretation of evolving price action for disciplined trading.

Diversification is about balance, not random asset selection. Next Gen Profit Ai studies how different crypto assets perform over time and uses AI to help traders build allocations that reduce exposure to sharp drops. This approach supports long term stability and helps traders maintain steady performance even during volatile market periods.

Next Gen Profit Ai’s AI also monitors fast moving price structures. By detecting sudden momentum shifts and quick reversals, the system provides timely feedback when conditions change rapidly. These insights help traders stay alert and adjust strategies for short term opportunities while keeping the broader trend in view.

New trends often begin quietly before becoming visible to most traders. Next Gen Profit Ai applies momentum analysis to spot these early shifts and translates them into clear, actionable signals. This allows users to position themselves ahead of broader market movements and improve timing for entries and exits.

Volatility isn’t always a warning sign, when interpreted correctly, it can be a clue. Next Gen Profit Ai uses AI to analyze price swings and determine whether volatility reflects a normal correction or a breakout. This structured view helps users interpret turbulence and adjust strategies with greater confidence.

Next Gen Profit Ai combines advanced AI with expert insights to improve decision making in digital assets. Its algorithms analyze large volumes of market data to identify trends and emerging opportunities, then turn the findings into structured, easy to use intelligence. This blend of technology and human context helps users build more dependable market understanding.

Built for adaptability, Next Gen Profit Ai delivers analytics that evolve with market behavior while remaining intuitive. Market shifts are evaluated with algorithmic precision and strategic perspective, enabling users to track meaningful moves in real time. The platform supports flexible, data backed decisions without sacrificing user control.

Next Gen Profit Ai uses advanced AI to analyze vast datasets, identify meaningful patterns, and deliver live market insights. Its adaptive models continuously refine analysis as conditions shift, keeping users updated on emerging opportunities and market changes in digital assets. This approach keeps research aligned with real time market behavior.

Designed for traders at all levels, Next Gen Profit Ai features an intuitive interface that makes complex market information easier to understand. AI insights support learning and confidence over time. The platform does not automate trades; instead, it empowers users to interpret data, create a plan, and execute independently while maintaining full control.

What sets Next Gen Profit Ai apart is its focus on clarity and transparency rather than automation. It combines AI with structured analytics to explain market changes, patterns, and macroeconomic influences. The platform supports informed decision making without trading on the user’s behalf, ensuring the trader retains control over strategy and execution.

| 🤖 Initial Cost | Registration is without cost |

| 💰 Fee Policy | Zero fees applied |

| 📋 How to Register | Quick, no-hassle signup |

| 📊 Educational Scope | Offerings include Cryptocurrency, Forex, and Funds management |

| 🌎 Countries Serviced | Operates globally except in the USA |